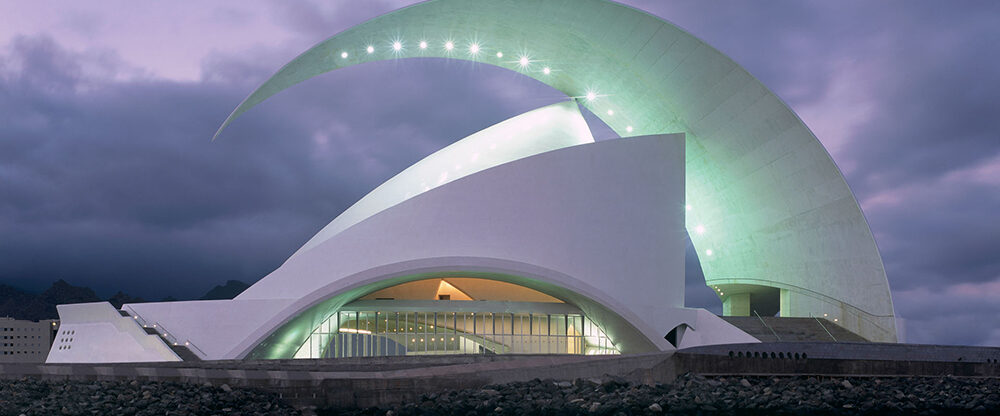

In Adivxy we offer you the best strategy to make your business profitable and achieve the growth that every great idea deserves, through the best taxation in Europe: Welcome to the Canary Islands!

THE BEST TAX REGIME IN EUROPE WITH A 4% CORPORATE INCOME TAX RATE

As an outermost region of the European Union (EU), the Canary Islands enjoy their own Economic and Fiscal Regime (REF), fully approved by the EU, in which the double taxation and fiscal transparency treaties apply.

0% VAT (WE DO NOT HAVE VAT!)

In the Canary Islands, VAT is not applicable. In its place, we have the IGIC (Impuesto General Indirecto Canario), whose general rate is 7%.

MAXIMUM GUARANTEE OF LEGAL SECURITY

Integrated in the legal and juridical system of the European Union (EU), the Canary Islands offer total guarantee of security and protection to individuals and companies. Data protection, free competition, financial regulations and familiarization with all international anti-corruption measures.

FULL INTEGRATION IN FISCAL TRANSPARENCY TREATIES

Application of European regulations, double taxation treaties, OECD and G20 regulations against tax evasion.

The Economic and Fiscal Regime (REF) of the Canary Islands fully respects all European legal and juridical policies.

TAX INCENTIVES

Reduction of up to 90% in undistributed net income.

50% bonus for the production of tangible goods.

Exemptions in direct taxation for incorporation of the company, capital increase and acquisition of investment goods.

INSTALLATION IN FREE ZONES

Economic advantages for the practice of exporting and importing.

DEDUCTIONS FOR AUDIOVISUAL PRODUCTION:

40% International

40-45% National

R&D&I DEDUCTIONS

Deduction of the full amount of corporate income tax.

Our Partners